Why portfolio choices is important

James Fisher's activities in our core markets are inextricably linked to environmental considerations related to climate change and the energy transition.

This creates specific risks and opportunities that, when properly managed, open new markets and revenue streams.

Over the past 10+ years, we have strategically funded environmentally sustainable growth by actively reinvesting cash from our legacy position in oil and gas into both established and growing positions in the renewable energy and environmental remediation value chains.

PORTFOLIO CHOICES

| KPI | BASELINE(2021) | TARGET | TARGET DATE |

| % Revenue from renewables and remediation offerings | 17% | During 2022, we will set clear targets, with the aim to report in 2023. | |

Progress in 2021

During 2021, we focused our efforts on three key areas:

- Active portfolio management

- Global contract wins

- Climate-related risk and opportunity analysis

Active portfolio management

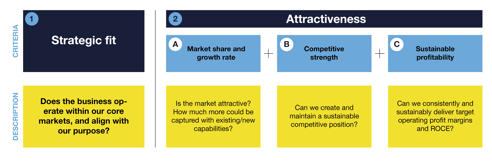

In line with our stated objectives and target, we developed and deployed a set of clear tests underpinned by well-established frameworks to assess all businesses within our portfolio.

The outcome of this assessment informed critical decisions on what businesses to fix, exit, and invest in for future growth. For example, the decision to sell James Fisher Testing Services and James Fisher NDT was based on strategic fit; the onboarding of a Broad-based Black Economic Empowerment (BBBEE) partner into James Fisher Subtech, South Africa was to improve our competitive strength.

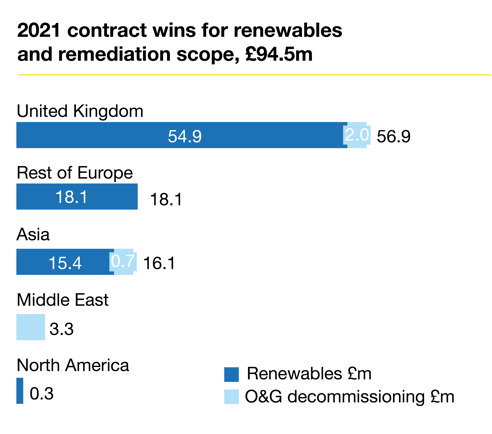

Global contract wins

Our efforts to reposition James Fisher operating companies as leaders within their chosen capabilities in the global renewables and remediation value chain is yielding fruit, with significant contract wins realised during 2021.

The services we will provide span across a range of capabilities, including:

- OFTO asset management

- Noise attenuation with big bubble curtains

- Asset commissioning, including HV safety management

- Topsides inspection, repair and maintenance

- Terminations and testing

- Cutting and dredging services

- Wellhead severance

- Pull-in high voltage cables

- UXO investigation and removal

- Crane delivery for HVDC platforms

- Blade inspection and repair

Climate-related risk and opportunity analysis

We engaged the services of specialist consultants to evaluate climate-related risks and opportunities facing the group. The exercise involves a climate scenario analysis, an important and useful tool used to identify and assess the implications of different future climate scenarios and associated levels of global warming, including:

- Policy, legal, technology and reputational risks in the different warming scenarios

- Opportunities such as new markets and new products that may arise

The exercise will inform strategic decision making, financial planning, and the development of appropriate corporate governance structures that help to pre-empt climate-related risks and opportunities. Specifically, this will provide James Fisher with:

- An improved understanding of the potential impact of climate change scenarios on the business across all stakeholder groups

- A climate scenario analysis quantification tool which will enable us to actively track real world events against modelled scenarios and to adapt its planning accordingly

- A stronger positioning that satisfies all TCFD reporting requirements and recommendations

How we will deliver against targets

Set new portfolio boundaries

To better focus efforts, we have structured our core capabilities into three broad categories:

- Energy solutions

- Remediation

- Life preservation

Energy solutions

Development of products, services, and solutions for the energy industry, with a focus on renewables (offshore wind).

James Fisher will continue to deliver services to the oil and gas industry where it makes sense to do so, e.g., where our standards of safety and service quality mean that withdrawing our expertise would result in a net negative impact on the planet.

Remediation

Removal of pollutants or contaminants from and restoration of the environment.

Current efforts are focused on growth in decommissioning of oil and gas infrastructure, with the aim to expand other remediation scopes such as oxygenation and remediation for aquaculture, flare gas reduction, emissions monitoring, and waste management.

Life preservation

Development of products, services, and solutions that preserve the life of people, assets, and other life forms in the environments where we operate.

JFD, one of our portfolio businesses, is specialised in submarine escape and rescue and provides a range of innovative and highly capable underwater life support systems for defence divers. The development of offering and capabilities for marine life preservation would be an obvious extension for the group, and we will continue to evaluate this as other priorities are successfully managed.

Key priorities under the planet pillar of our sustainability strategy

Along with portfolio choices, these are the key priorities under our planet pillar

You may also be interested in

James Fisher strengthens APAC commitment with Japan entity

Read article

Shipping through the generations: World Maritime Day 2022

Read article

JF Renewables supplies HV support services to Formosa 2 wind farm in Taiwan

Read article

James Fisher and Sons plc half year results for the six months ended 30 June 2022

Read article

James Fisher Renewables and ScanTech Offshore champion North American offshore wind with VP appointment

Read article

James Fisher Renewables backs APAC offshore wind growth with key appointments

Read article

James Fisher and Abu Dhabi's NMDC Group sign strategic agreement

Read article

James Fisher Renewables commits to further investment in Taiwan to support local government

Read article